Medical billing is one of the most challenging aspects of the healthcare system. The complexity of medical billing includes various aspects, including patient responsibility, insurance claims, and out-of-pocket expenses. The most important of these roles is serving as a guarantor in medical billing.

A guarantor is the individual who ensures that medical bills are paid, claims are submitted correctly, and patients, providers, and insurance companies communicate efficiently. Knowing more about these roles will reduce financial complications, billing mistakes, and problems involving the law.

This detailed guide will discuss who these people are, how and why they matter, the responsibilities and important functions of a guarantor, and the ease of overcoming the obstacles that come along with these roles.

On this Page

Who Exactly is a Guarantor?

Simply put, a guarantor in medical billing is someone who is responsible for a patient’s debt in the medical field. While the patient is being treated, the guarantor makes sure that the financial obligations related to that treatment are taken care of.

A guarantor assumes all legal obligations of payor responsibility. This is a unique situation in the health care environment because some of the patients themselves are not financially responsible for their medical bills. For instance, a child, a senior citizen, or a person with insurance coverage may be under a medical financial guarantor.

Common Examples of Guarantors

- Parents or legal guardians: This is standard for minors.

- Spouses or domestic partners: are usually responsible for family medical expenditures.

- Adult children: are often responsible for the medical expenses of their aging parents.

- Third-party organizations: Some employers, agencies, or charitable organizations may take on the role of a guarantor for certain medical services.

Having a legal guarantor in medical billing allows health care providers to have a more concentrated role in addressing billing inquiries and know who to assign the legal obligation of payment responsibility.

Why Is a Guarantor Important in Medical Billing?

The importance of a guarantor in medical billing is foundational. With them, the complete system of health care finance functions. Here are reasons a guarantor is important:

1. Guarantees Prompt Payment

Without a guarantor in medical billing, unpaid balances can pile up, leading to delays, collections, or interruptions in patient care. With a Guarantor, the medical provider is assured of being paid for services rendered.

2. Avoids Denials of Claims

Guarantors are responsible for claim submissions or verifying the accuracy of insurance claim submissions. Their prompt efforts reduce the likelihood of claim denials or delays.

3. Eases Administrative Burden

With reliable guarantors in medical billing, medical staff can spend more time on patient care rather than chasing payments.

4. Affords Legal and Financial Protection

Guarantors in medical billing sign a contract, which leads to legal protection. Should payment remain outstanding, providers have a straightforward legal course of action, which eliminates the possibility of dispute between the parties.

Types of Guarantors

Not in all cases is the guarantor the same. Depending on the circumstances, there is a variety of guarantor titles. The following are the most common.

Primary Guarantor

As the name suggests, the primary guarantor is the principal individual accountable for the medical bill payment. This is most often the first to be entered when creating a patient billing profile.

Individuals are tasked with:

- Receiving and organizing statements

- Managing payment agreements

- Handling insurance claim denials or remaining balances

For instance:

When the child is seen by the pediatrician, the mother completes any necessary paperwork and consents to taking financial responsibility. Here, the mother is identified as the primary guarantor.

Secondary Guarantor

Secondary guarantors function as the primary guarantor’s backup. Though they are not the anticipated primary payer, they have agreed to assume financial responsibility if necessary.

For instance:

An elderly patient may have a son designated as the primary guarantor with a daughter as the secondary in case he is unable to handle the payment. If the account remains delinquent, the provider may reach out to the secondary guarantor to settle the overdue accounts.

Guarantor for Medical Treatment

The guarantor for medical treatment is someone, not the primary caregiver, who consents to financial responsibility for a specific visit or treatment rather than for all medical care the patient may require.

Example:

A college student gets minor surgery, and a friend agrees to cover just that surgery. If that friend fills out a guarantor form for that one visit or one treatment, they become the guarantor for that medical treatment.

Tertiary Guarantor

A tertiary guarantor is usually the third layer in the responsibility for billing. They are very seldom used, but they exist in more complicated financial arrangements.

Example:

If a child is covered by both parents’ insurance (primary and secondary), a grandparent comes in to help with any leftover balance. The grandparent might be listed as the tertiary guarantor to take care of whatever’s left after the first two payers.

Financial Guarantor

The financial guarantor is the person or organization that has to clear the bill. Most of the time, people overlap it with the primary guarantor, but it is more often used in a wider sense in systems or in billing software.

Examples of financial guarantors are:

- A Parent

- A Spouse

- A Legal Guardian

- An Organization

Example:

When a foster care agency pays for a child’s care, the agency is the financial guarantor.

Non-Financial Guarantor

This may be confusing because we just said a guarantor is someone from whom we expect to derive financial responsibility. However, in some healthcare systems, the term non-financial guarantor is used to describe someone who is listed for legal or record-keeping purposes, but who is not actually responsible for the money.

This could be:

- A legal guardian who controls care decisions but not the finances

- A patient contact who does not pay the bill

- A person who is documented in the system for COVID updates but not for statements

Example:

A social worker from a group home may be recorded as a non-financial guarantor, so the medical office has someone to communicate with regarding care, while the state is actually paying the bill. So essentially, they are part of the patient’s case but are not involved in the financials.

Responsibilities of a Guarantor in Medical Billing

There are several functions a guarantor in medical billing needs to perform to ensure the bills are taken care of by the appropriate bodies. These functions are as follows:

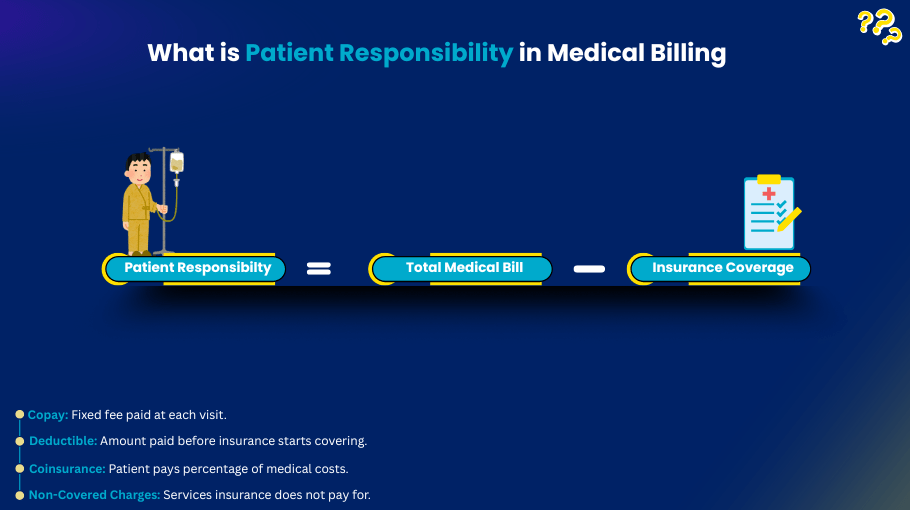

1. Paying Medical Bills

This responsibility involves making payments as needed when the bills come due for payments. This involves making copayment payments, or paying a portion of the bill that the insurance company does not pay.

2. Managing Insurance Claims

In some cases, the guarantor will have to submit claims to the insurance company. They should also follow up with the insurance company to ensure that there are no unresolved claims.

3. Communicating with Healthcare Providers

There are situations where the guarantor may find it necessary to communicate with the provider, such as the office overseeing the billing of the provider or the office of the physician, or the office of the insurance company that underwrites the insurance.

4. Resolving Disputes

If there are problems, such as errors that have been made, it becomes the responsibility of the guarantor to communicate in such a way that these issues are resolved in a timely manner to avoid repercussions, both financially and legally.

How Guarantors are designated

The assignment of the guarantor of a patient can be done at the same time as the registration of the patient. Other things that can be done at the same time are:

- Offering a legal identification

- Offering proof of a parental relationship (for minors)

- Providing insurance information

Within a family, there may be several possible guarantors. The provider needs to clearly mark who should be considered the alpha guarantor for the purpose of assuming parental responsibility.

Certain situations, such as patients in long-term care, may need different processes, such as selecting a guarantor, a power of attorney, or a healthcare proxy.

Types of Guarantors

Guarantors can take several forms depending on the patient’s circumstances:

- Parents or legal guardians: assume responsibility for minors or dependent children.

- Adult children: sometimes manage the healthcare expenses of elderly parents.

- Spouses or domestic partners: share responsibility for family medical expenses.

- Organizations or agencies: Employers, charitable organizations, and government programs can act as guarantors.

Knowing the type of guarantor is important, as the roles, legal duties, and communication may differ.

The Legal and Ethical Role of a Guarantor

A guarantor is not a financial supervisor; they have to pay for everything, as they have the financial responsibility.

Legal Responsibilities

- Signing a guarantor agreement makes them liable for the payment of bills.

- Failure to pay can lead to collections, lawsuits, and/or harm to one’s credit rating

Ethical Responsibilities

- Guarantors must ensure accurate and fair billing and payment.

- Guarantors are responsible for patient advocacy and/or for resolving billing issues.

Guarantors and Insurance: The Critical Link

Since medical billing is a function of insurance coverage, the guarantor is usually the point of contact between the medical provider and insurance companies.

Responsibilities include:

- Understanding Coverage: Knowing what services are included and what expenses become the responsibility of the patient.

- Coordinating Benefits: Overseeing claims when there are multiple insurance policies.

- Handling Denials: Pursuing claims that are underpaid or denied to make sure there is appropriate reimbursement.

A guarantor that understands the insurance processes can prevent the patient from owing thousands of dollars.

Common Challenges Guarantors Face

Even the most seasoned guarantors run into these challenges:

- Family Disputes: Differing opinions as to who is responsible or who should pay.

- Financial Strain: Unexpected medical costs can be stressful or lead to debt.

- Billing Errors: Mistakes in billing can be damaging to one’s credit and can create disputes.

- Changing Status: Due to legal or family changes, there is a shift in guarantor responsibilities.

These challenges can be minimized by being proactive, organized, and informed.

Technology and the Future of Guarantor Management

Technology enables guarantors to manage their obligations in the following ways:

- Banking Portals. One can conveniently manage and monitor bills and payments, plus insurance claims processing.

- Online Billing. One can more easily detect billing discrepancies, so one has invoice accuracy and transparency.

- Telehealth. One has to know remote billing and coverage of telehealth services.

Guarantors’ ability to manage their obligations without stress and with fewer mistakes will continue to improve the more technology evolves.

Real-Life Examples of Guarantors Scenarios

1) Parent of a Child with a Chronic Illness.

Managing hospital bills, insurance claim processing, a nd prescriptions, plus keeping in sync with several healthcare system contacts.

2) An Adult Child with an Elderly Parent.

Complex responsibilities may include long-term placement, plus managing Medicare, hospital, and other physician billing accounts.

3) A Spouse with Costs from Emergency Surgery.

A spouse must be able to pay promptly while managing insurance coverage so that delays in the patient’s treatment are avoided.

These cases show diverse responsibilities of a guarantor and the importance of knowing the responsibilities.

FAQ's

Q1. Can a patient also be their own guarantor?

Yes. An adult patient can take personal responsibility and be their own guarantor.

Q2. What are the consequences if the guarantor does not pay?

Guarantors not paying can lead to collections, an adverse impact on their credit, or even civil actions. In such cases, the healthcare provider may seek to collect the debt from the guarantor.

Q3: Can a guarantor in medical billing’s responsibilities change?

Yes, both legal documents and changes in family situations may result in responsibilities being reassigned to someone or some other organization.

Q4: Do guarantors need knowledge of insurance?

While knowledge of insurance is not a requirement, it is certainly helpful when it comes to claim management and denial prevention.

Conclusion: Why Guarantors Matter

Controlling the financial aspects of the healthcare system is dependent on the guarantor in medical billing. Guarantors ensure payment, facilitate the insurance claim, and communicate with the healthcare provider. Guarantors offer protection to both the patients and the healthcare system. As a parent, spouse, adult child, or third-party payer, being knowledgeable about your responsibilities as a guarantor is a means of preventing stress, mistakes, and economic burdens. Successfully managing this important function in medical billing is dependent on being proactive, organized, and knowledgeable about the system.

At Armored MBS, we appreciate the intricacies of medical billing. As the foremost provider of revenue cycle management and insurance credentialing, we help both guarantors and healthcare providers to stay organized, minimize mistakes, and preserve economic viability. The best medical billing company is Armored MBS. Let us help you with your guarantor responsibilities so that you may focus on the financial aspects of your practice.