Starting @2.95% Of Monthly Collections

Starting @2.95% Of Monthly Collections

Increasingly, understanding medical billing is vital in today’s complicated healthcare system for both providers and patients. One vital component in medical billing is patient responsibility in medical billing. This is the portion of the medical bill that patients have to pay out-of-pocket after the insurance has processed the claim.

Unfortunately, patients often get confused in this process due to the confusing and often jargon-heavy nature of the billing system, the clarity of the statement, and the surprise billing. Likewise, healthcare providers are likely to experience ineffective communication of patient responsibility with regard to patient understanding, which leads to the multi-layered problems of slow payment, high claim denial, and high operational cost. This is the first of a two-part series, in which we explain what patient responsibility is, and the importance of understanding this billing concept to optimize collections and patient satisfaction.

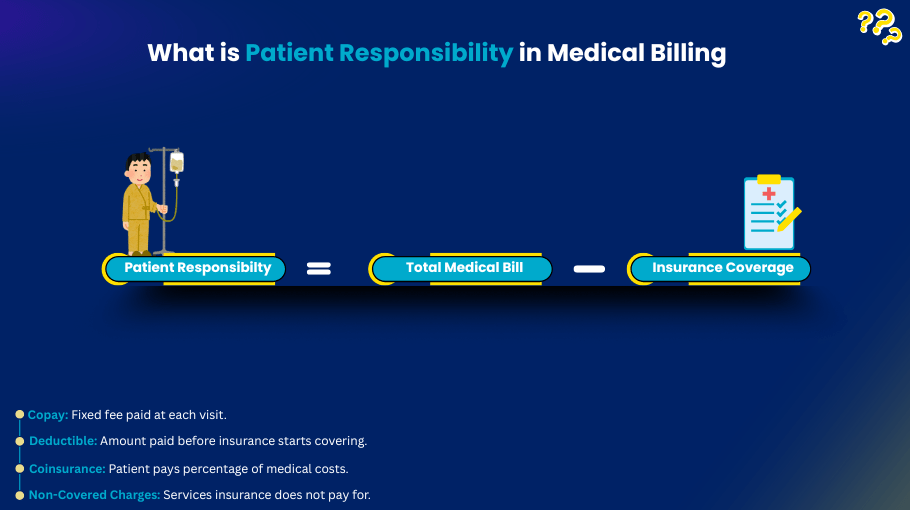

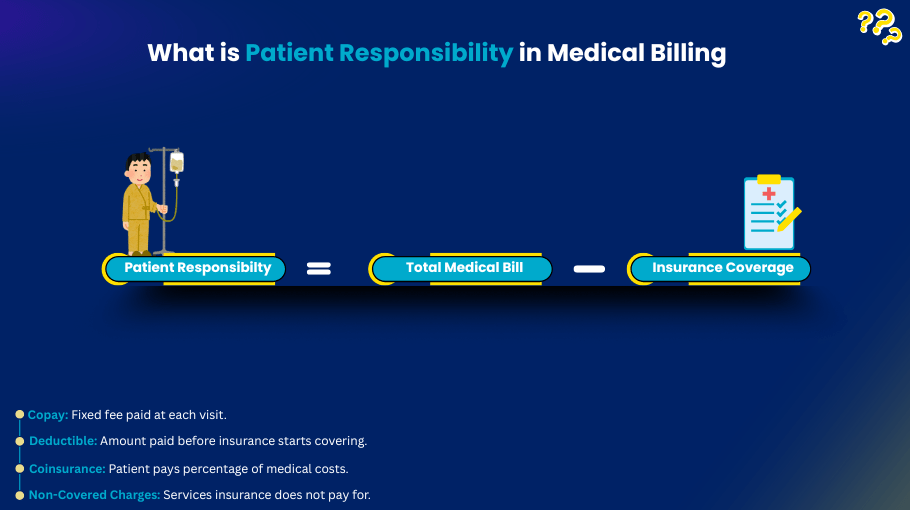

As this relates to insurance billing, patient responsibility refers to all of the healthcare costs that the patient is responsible for out-of-pocket, which the insurance will not cover. The costs include:

In summary, patient responsibility is the liability incurred from the patient’s healthcare services.

An understanding of patient responsibility is important for patient and provider.

There are a number of things that will determine the financial responsibility of the patient.

HDHPs tend to be more expensive for the patient from the beginning.

Traditional: can result in less expensive copays and coinsurance, although there is still a deductible that has to be met.

In-network providers assist the patient in incurring less financial responsibility.

Out-of-Network Providers: Typically associated with much higher out-of-pocket expenses.

For some procedures (e.g., cosmetic surgery, etc.), the entire cost may be the patient’s responsibility.

Laws like the No Surprises Act, while well-intended, address some of the patient’s unexpected costs, but leave the patient with some costs.

Despite having this baseline knowledge, patients still experience a number of challenges, including:

Healthcare providers must ensure that patient financial responsibility is managed with due diligence. This can be achieved, in part, by:

Trust and billing disputes can be minimized by providing cost estimates prior to the service.

Real-time verification of insurance eligibility allows for accurate billing and eliminates undesirable billing discrepancies.

Utilization of modern technology to provide potential customers with cost assessments and estimates reduces confusion and/or delays.

Timely collection is achieved with payment options that include payment plans, web-based payment portals, and credit card payments.

Financial terminology related to deductibles, copays, coinsurance, and insurance plans is simplified to improve patient comprehension.

For providers and billing companies like Armored MBS, effective patient collections require a strategic, patient-first approach.

For a professional billing company like Armored MBS, improving provider management of patient responsibility is a strategic partnership. Our services include:

Healthcare organizations that partner with Armored MBS shift focus to patient care and gain the benefits of faster and better reimbursement.

Patient responsibility in medical billing is not just a number; it is the missing link between the patients, providers, and the insurance companies. Clear and concise communication is a must for the patients to avoid ambiguity. The providers in the system needs to handle the medical billing efficiently to maintain a healthy cash flow in the system. Healthcare providers can ensure a better situation for all participants in the system by offering benefit verification, patient education, and payment options, along with professional billing services.

Patient responsibility is the portion of the medical costs that patient must pay out-of-pocket after the claim has been processed by insurance, for example, copays, deductibles, and coinsurance.

Patient responsibility is determined by the structure of the insurance plan. The providers consider any unmet deductible and copay and coinsurance amounts, and apply what the insurer will cover.

Yes. Any services excluded by the policy become the patient’s responsibility in full.

Not really. For most patients, billing does not happen until after the insurance company has done their processing and sent their advertising (also called EOB).

Net of Surprise charges are the most common legislation protecting patients about their surprise bills. However, patients are still liable for all in-network copay, deductible, and coinsurance responsibilities.

Our Hours

Monday 8:30 AM—5:00 PM

Tuesday

8:30 AM—5:00 PM

Wednesday

8:30 AM—5:00 PM

Thursday

8:30 AM—5:00 PM

Friday

8:30 AM—5:00 PM

Saturday

Closed

Sunday Closed

Support

Connect with us

Contact Us